Payroll

How to Calculate Employer’s National Insurance (NI) Contributions – Employer NI Contributions Changes for 2024-2026, Effective April 2025

Elena Segura

Co-Founder

Apr 7, 2025

Compare Your Employer Costs: Download the 2024/25 & 2025/26 NI Calculator (Excel)

What Are Employer’s National Insurance (NI) Contributions?

Employer National Insurance (NI) contributions are a key component of the payroll process in the UK. These contributions help fund essential services, including the NHS, state pensions, and unemployment benefits. For employers, understanding how to calculate National Insurance contributions is essential to meet compliance requirements and avoid penalties. This guide explains how to calculate National Insurance, with a specific focus on the employer NI contributions changes effective April 2025.

Overview of Recent Employer National Insurance Changes

The UK government periodically updates National Insurance rates and thresholds to reflect economic conditions and policy shifts. In April 2025, significant changes will affect employer National Insurance contributions.

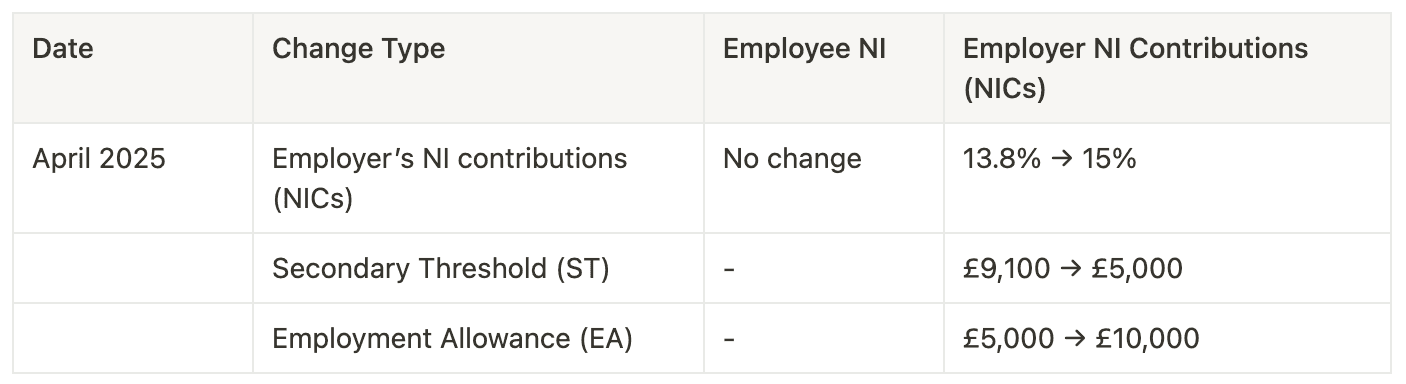

Below is a summary of the upcoming National Insurance changes:

Reduction in the Secondary Threshold: The NICs Secondary Threshold will be lowered from £9,100 to £5,000 starting 6 April 2025.

Increase in Employers' NICs Rate: The main rate for Secondary Class 1 NICs (paid by employers) will rise from 13.8% to 15% for earnings paid on or after 6 April 2025.

Higher Employment Allowance: The maximum Employment Allowance will increase from £5,000 to £10,500 for claims made on or after 6 April 2025.

This table highlights the main National Insurance changes for 2025, showing how the employer NI rate and thresholds will be adjusted to impact payroll expenses.

Compare Your Employer Costs: Download the 2024/25 & 2025/26 NI Calculator (Excel)

Increase in Employer's National Insurance Contributions

Starting April 2025, the employer National Insurance contribution rate will increase by 1.2 percentage points, reaching 15%. Additionally, the Secondary Threshold (ST) for employer National Insurance contributions will be lowered, meaning employers will begin paying National Insurance on employees' earnings starting from £5,000, down from the previous threshold of £9,100. These adjustments in National Insurance rates and thresholds are expected to increase the National Insurance contributions for employers, especially those with lower-wage employees, as a larger portion of employee earnings will be subject to National Insurance.

How the 2025/26 NI Changes Affect Employer Costs Across Different Salaries

The changes to Employer National Insurance (NI) contributions in 2025/26 will result in a noticeable increase in employer costs across different salary levels. The data highlights that lower-wage employees (£20,000 per year) will see the highest percentage increase in employer costs at 3.37%, with total employer costs rising from £22,104.80 to £22,850.00—an increase of £745.20. For employees earning £50,000 annually, the employer cost will rise from £57,144.80 to £58,250.00, an increase of £1,105.20 (1.93%). Similarly, for those earning £75,000, the total employer cost will rise from £86,344.80 to £87,750.00, reflecting an increase of £1,405.20 (1.63%). This suggests that businesses employing lower-paid workers, such as those in retail and hospitality, may bear a proportionally heavier financial burden compared to those with higher-paid employees. While the absolute increase in employer costs is greater at higher salary levels, the relative impact is more significant for lower wages. This shift could incentivize businesses to reconsider workforce structures, explore efficiency improvements, or leverage available reliefs, such as the enhanced Employment Allowance, to mitigate rising costs.

For £20,000 Salary

For a salary of £20,000, the annual increase in employer costs is £745.20, which represents a 3.37% increase.

For £50,000 Salary

For a salary of £50,000, the annual increase in employer costs is £1,105.20, which represents a 1.93% increase.

For £75,000 Salary

For a salary of £75,000, the annual increase in employer costs is £1,405.20, which represents a 1.63% increase.

Compare Your Employer Costs: Download the 2024/25 & 2025/26 NI Calculator (Excel)

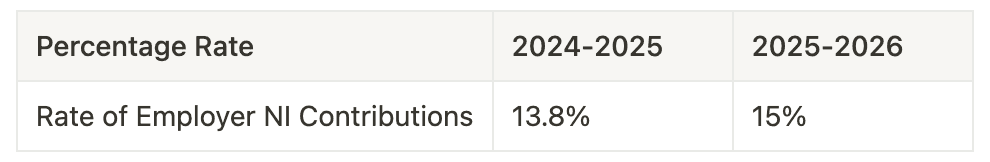

Employer National Insurance Contribution Rates for 2024-2025 and 2025-2026

For financial planning, here is a table showing the Employer NI contribution rates for the 2024-2025 and 2025-2026 tax years:

Understanding these National Insurance rates helps employers plan for future payroll costs accurately, as National Insurance obligations will vary between these years.

Monthly National Insurance Thresholds for 2024-2025 and 2025-2026

Here are the monthly National Insurance thresholds, specifying when both employees and employers begin paying National Insurance contributions. Accurate National Insurance calculations require close attention to these thresholds:

These National Insurance thresholds reflect changes in the Secondary Threshold (ST) for employers in 2025-2026, affecting employer National Insurance obligations.

NICs earnings limits will apply from 06 April 2025.

To ensure compliance with updated National Insurance rules, it's essential to be aware of the earnings limits that will apply from 6 April 2025. Below is a breakdown of the new thresholds.

Example Calculation of Employer and Employee National Insurance for 2024-2025 and 2025-2026

The following example demonstrates how employer and employee National Insurance contributions vary across different salary ranges for the 2024-2025 and 2025-2026 tax years. This comparison helps employers apply the updated National Insurance rates and thresholds for precise National Insurance calculations:

Understanding the Employment Allowance: Eligibility and New Benefits for Employers

The Employment Allowance (EA) is a relief on employer National Insurance contributions. Beginning April 2025, the EA will increase from £5,000 to £10,500. This increase in National Insurance allowance aims to support small and medium-sized businesses by lowering their National Insurance liability. Larger employers, who previously faced an NI liability cap, will now be able to claim the full Employment Allowance, providing significant National Insurance relief.

FAQs on National Insurance Contributions

What is National Insurance?

National Insurance is a UK tax on earnings that funds various state benefits, including the NHS, pensions, and unemployment benefits.

When do employers start paying National Insurance for employees?

Employers start paying National Insurance contributions when employee earnings exceed the Secondary Threshold (ST), set at £758 per month in 2024-2025 and lowered to £416.67 per month for 2025-2026.

How are National Insurance contributions calculated?

National Insurance contributions are based on employee earnings and specific thresholds that differ for both employees and employers. Employers use thresholds such as the Secondary Threshold (ST) and follow rate categories to calculate National Insurance accurately.

How will the 2025 changes impact my business?

The 2025 changes in National Insurance will raise the employer’s NI rate to 15% and reduce the ST threshold, meaning National Insurance will apply to a larger portion of employee earnings. This may increase payroll costs for businesses.

What is the Employment Allowance, and who can claim it?

The Employment Allowance (EA) reduces National Insurance liabilities for eligible employers. From 2025, the EA will increase from £5,000 to £10,000, offering valuable National Insurance savings for SMEs and other eligible employers.

What can employers do to prepare for these changes?

Employers should:

Review payroll costs to understand the impact of the rate increase and threshold change.

Consider implementing salary sacrifice schemes to reduce NIC liabilities.

Take full advantage of the Employment Allowance.

Consult with a Givver.io to optimize payroll processes and manage costs.

Will these changes impact employees’ take-home pay?

No, Employer NICs are paid directly by the employer and do not affect an employee’s gross salary or take-home pay.

How will the upcoming Employer National Insurance changes impact businesses, particularly in sectors with lower-paid workers?

The upcoming Employer NI changes, set to take effect in April 2025, will raise costs for businesses, particularly in industries with a high proportion of lower-paid workers, such as hospitality and retail. Larger companies might absorb these costs through operational efficiencies or pricing adjustments, but small and medium-sized businesses could experience financial pressure. Employers may need to explore cost-saving strategies or take advantage of the increased Employment Allowance to help offset the impact.

How to Calculate Employer's National Insurance (NI) Contributions

Calculating your employer's National Insurance (NI) contributions accurately is essential to ensure compliance with HMRC regulations. As of April 2025, changes to employer NI rates and thresholds are set to impact businesses across the UK. Here’s a step-by-step guide to help you calculate the correct contributions.

Step 1: Identify the Employee’s Earnings

To calculate employer NI, start by determining the employee’s gross earnings. This includes salary, bonuses, and any other niable benefits (i.e., benefits that are subject to National Insurance contributions).

Step 2: Check the National Insurance Category

Different categories of employees (such as apprentices or under-21s) may have varied contribution rates. Employers need to verify the correct NI category for each employee before proceeding with calculations. Below is a comprehensive list of NI category letters and their corresponding employee groups:

NI Category Letters and Employee Groups

A: Most employees apart from those in groups B, C, H, J, M, V, and Z.

B: Married women and widows entitled to pay reduced National Insurance.

C: Employees over the State Pension age.

D: Investment Zone employees who can defer NI because they are already paying it in another job.

E: Investment Zone - married women and widows entitled to pay reduced National Insurance.

F: Freeport employees.

H: Apprentices under 25.

I: Freeport - married women and widows entitled to pay reduced National Insurance.

J: Employees who can defer National Insurance because they’re already paying it in another job.

K: Investment Zone - state pensioners.

L: Freeport employees who can defer NI because they’re already paying it in another job.

M: Employees under 21.

N: Investment Zone employees.

S: Freeport - state pensioners.

V: Veterans (employees working in their first job since leaving the armed forces).

Z: Employees under 21 who can defer NI because they’re already paying it in another job.

X: Employees who do not have to pay National Insurance (e.g., under 16).

Step 3: Use the Formula and Example Calculation

An employee in NI category A who earns £2,000 per month will have their National Insurance (NI) contributions calculated in several steps.

First, for the portion of earnings up to the Secondary Threshold (ST) of £417, the employer NI contribution rate is 0%, so the employer pays £0.

Next, for the portion of earnings between the ST and the Freeport Upper Secondary Threshold (FUST), which amounts to £1,583, the employer NI contribution rate is 15%. This results in an employer NI contribution of £237.45 (calculated as £1,583 × 15%).

Then, for the earnings between the Primary Threshold (PT) and the Upper Earnings Limit (UEL), which total £952, the employee NI contribution rate is 8%. This results in an employee NI contribution of £76.16 (calculated as £952 × 8%).

There are no earnings between the FUST and UEL, nor any above the UEL, meaning the contributions for those parts are £0.

In summary, the total NI due for this period is £76.16 for the employee and £237.45 for the employer.

Compare Your Employer Costs: Download the 2024/25 & 2025/26 NI Calculator (Excel)

No more juggling multiple systems or drowning in spreadsheets.

Sign up for free